Introduction to Loan Accounting Reports

Are you ready to dive into the world of loan accounting reports and uncover the key strategies that can revolutionize your financial decision-making? Buckle up as we explore the intricacies of analyzing loan accounting reports, unraveling their importance, discussing different types of loans, and revealing common mistakes to avoid. Get ready to supercharge your loan performance with expert tips and insights in this must-read blog post!

Importance of Analyzing Loan Accounting Reports

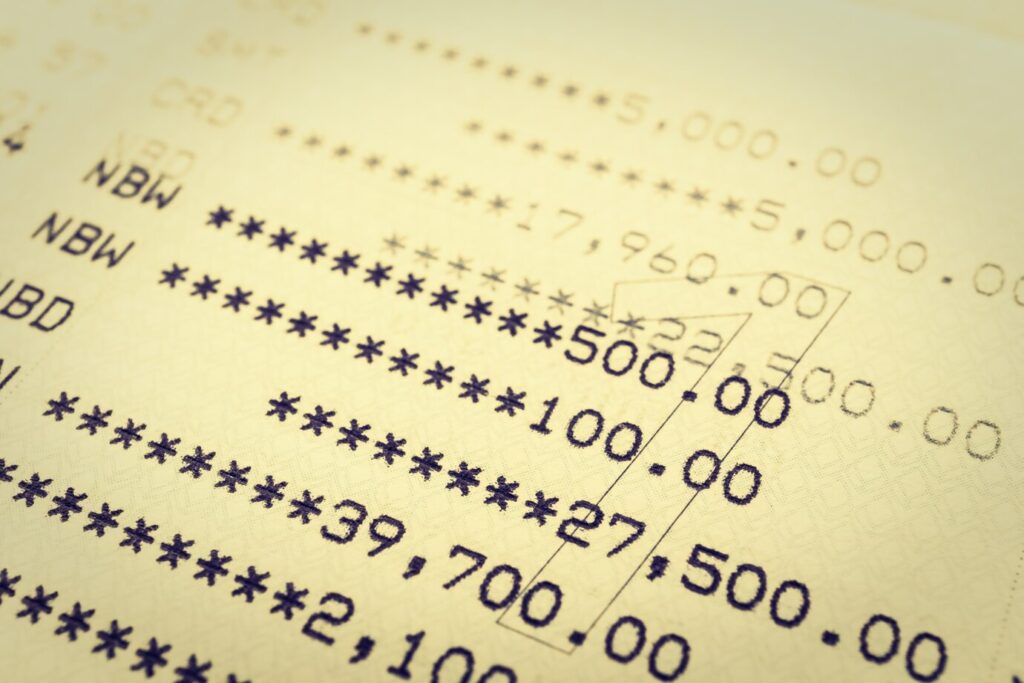

Loan accounting reports play a crucial role in providing valuable insights into the financial health of a lending institution. By analyzing these reports, lenders can gain a comprehensive understanding of their loan portfolio performance, identify potential risks, and make informed decisions to optimize profitability.

Understanding the trends and patterns within loan accounting reports allows lenders to assess the effectiveness of their lending strategies and adjust them accordingly. It helps in detecting any irregularities or discrepancies that may indicate financial mismanagement or fraudulent activities.

Furthermore, by closely examining key metrics such as delinquency rates, loan loss provisions, and interest income, lenders can proactively address issues before they escalate. This proactive approach not only safeguards the financial stability of the institution but also enhances customer trust and loyalty.

In today’s dynamic economic environment, where market conditions constantly evolve, analyzing loan accounting reports is essential for staying competitive and ensuring long-term success in the lending industry.

Key Strategies for Analyzing Loan Accounting Reports

When it comes to analyzing loan accounting reports, having key strategies in place can make a significant difference in understanding the financial health of your loans. One essential strategy is to regularly review and compare historical data with current figures. This helps identify trends and deviations that may require attention.

Another important strategy is to pay close attention to key performance indicators (KPIs) such as delinquency rates, default rates, and profitability metrics. By focusing on these KPIs, you can pinpoint areas for improvement and take proactive measures to mitigate risks.

Additionally, it is crucial to analyze loan portfolios by segment, such as by loan type, borrower demographics, or risk level. This allows for a more detailed understanding of the performance and potential risks associated with each segment.

It is also essential to conduct a thorough review of any changes in accounting standards or regulations that may impact how loans are accounted for. These changes can have a significant impact on financial statements and should be closely monitored.

Lastly, utilizing technology and data analytics tools can greatly enhance the analysis process. These tools can help identify patterns and trends that may not be easily noticeable through manual analysis.

Overall, having a structured approach to analyzing loan accounting reports is key to making informed decisions and effectively managing loan portfolios. Regularly reviewing historical data, monitoring KPIs, segmenting portfolios, staying updated on regulatory changes, and leveraging technology are all essential components of an effective analysis strategy.

Additionally, conducting thorough data reconciliation ensures accuracy in the reporting process. Verifying transaction details and balances can help prevent errors that could impact decision-making based on inaccurate information.

Implementing robust tracking mechanisms for loan portfolios allows for real-time monitoring of performance metrics. This enables timely interventions when necessary and optimizes overall portfolio management efficiency.

Understanding the Different Types of Loans and Their Impact on Reports

When it comes to analyzing loan accounting reports, understanding the different types of loans is crucial. Each type of loan can have a unique impact on the financial reports generated by lending institutions.

For example, mortgage loans may show long-term repayment trends and interest accruals that differ from short-term personal loans. Understanding these nuances helps in accurately interpreting the data presented in the reports.

Here are some of the most common types of loans and their impact on reports:

1. Secured Loans

Secured loans are loans that require collateral, such as a car or home, to secure the loan. These types of loans have a lower risk for lenders since they can seize the collateral if the borrower defaults on the loan. As a result, secured loans typically have lower interest rates and longer repayment periods.

The impact of secured loans on reports is that they may show higher asset values and lower delinquency rates compared to unsecured loans. This is because borrowers are less likely to default on secured loans since they risk losing their collateral.

2. Unsecured Loans

Unsecured loans do not require collateral and are solely based on the borrower’s creditworthiness. These types of loans often have higher interest rates and shorter repayment periods compared to secured loans.

The impact of unsecured loans on reports is that they may show higher delinquency rates, which can be a cause for concern for lenders. Since there is no collateral to fall back on, lenders may face more difficulties in recovering funds from defaulted loans.

3. Installment Loans

Installment loans are repaid in fixed installments over a set period, usually with a fixed interest rate. These types of loans are commonly used for large purchases such as cars, homes, or appliances.

Additionally, various loan categories like commercial loans, student loans, or auto loans each come with their own set of accounting considerations. The way these loans are structured and managed can significantly affect how they are reflected in financial statements.

By having a clear grasp of the different types of loans and their implications on accounting reports, analysts and stakeholders can make more informed decisions regarding risk management strategies and overall financial performance evaluation.

Common Mistakes to Avoid When Analyzing Loan Accounting Reports

When diving into the world of loan accounting reports, there are some common mistakes that you’ll want to steer clear of to ensure accurate analysis. One frequent misstep is overlooking the details and not delving deep enough into the numbers presented. It’s crucial to scrutinize every aspect carefully.

Another pitfall to avoid is relying solely on automated tools for report analysis without fully understanding the data they generate. While these tools can be helpful, human oversight and interpretation are still essential in catching potential errors or discrepancies.

Furthermore, failing to consider external factors such as economic trends or regulatory changes when interpreting loan accounting reports can lead to a skewed analysis. Context matters greatly in this realm.

Neglecting regular reviews and updates of your analytical processes can result in outdated insights and missed opportunities for optimization. Stay vigilant and continuously refine your approach for more accurate assessments.

Tips for Improving Loan Performance Based on Report Analysis

When it comes to improving loan performance based on report analysis, there are several key tips to keep in mind. Ensure you thoroughly understand the data presented in the reports – take note of trends, outliers, and any areas that may require further investigation.

Identify any red flags or warning signs that the reports may reveal. This could include high delinquency rates, low repayment rates, or inconsistencies in financial information provided by borrowers.

Next, develop a proactive strategy to address any issues identified through the analysis. This could involve implementing stricter lending criteria, offering financial education programs to borrowers, or restructuring existing loans to better suit borrower needs.

Additionally, regularly monitor and reassess your loan portfolio based on updated reports. By staying vigilant and responsive to changes in data patterns over time…

Remember: report analysis is not a one-time task but an ongoing process that requires attention and adaptability for continued success in managing loan performance effectively.

Conclusion

Analyzing loan accounting reports is crucial for financial institutions to make informed decisions and improve their loan performance. By understanding the key strategies, types of loans, and common mistakes to avoid, lenders can effectively interpret these reports and take proactive steps towards managing their loan portfolios efficiently. With a keen eye on report analysis and continuous improvement based on insights gained, financial institutions can optimize their lending practices and drive better outcomes in the long run.